The Importance of Event Tracking in Banking

- Reading Time: 8 minutes

In the competitive world of banking, staying ahead requires more than traditional financial skills. Leveraging advanced technology is crucial, and event tracking has emerged as a pivotal innovation. By offering deep insights into customer behavior, operational efficiency, and overall performance, event tracking drives success and innovation.

For example, Turkey’s first national bank, İşbank utilized Dataroid for event tracking and got remarkable results. They saw a 33% conversion rate for digital users visiting the gold savings account page, a 38% conversion rate for customers offered an instant credit card limit increase, and 400,000 customers updated their digital channel preferences during the pandemic without visiting a branch. These impressive statistics underscore the transformative potential of event tracking in the banking sector.

Thus, modern banking generates vast amounts of customer data. By integrating and analyzing this data, banks can better understand customer needs, manage risks, and uncover new growth opportunities. Event tracking not only enhances personalized customer experiences but also acts as an early warning system for potential issues.

What is Event Tracking and Why it Matters in Banking?

Event tracking refers to the process of monitoring and analyzing customer interactions with banking services in real-time. This practice is essential for understanding the customer journey, managing risks, and discovering new growth opportunities.

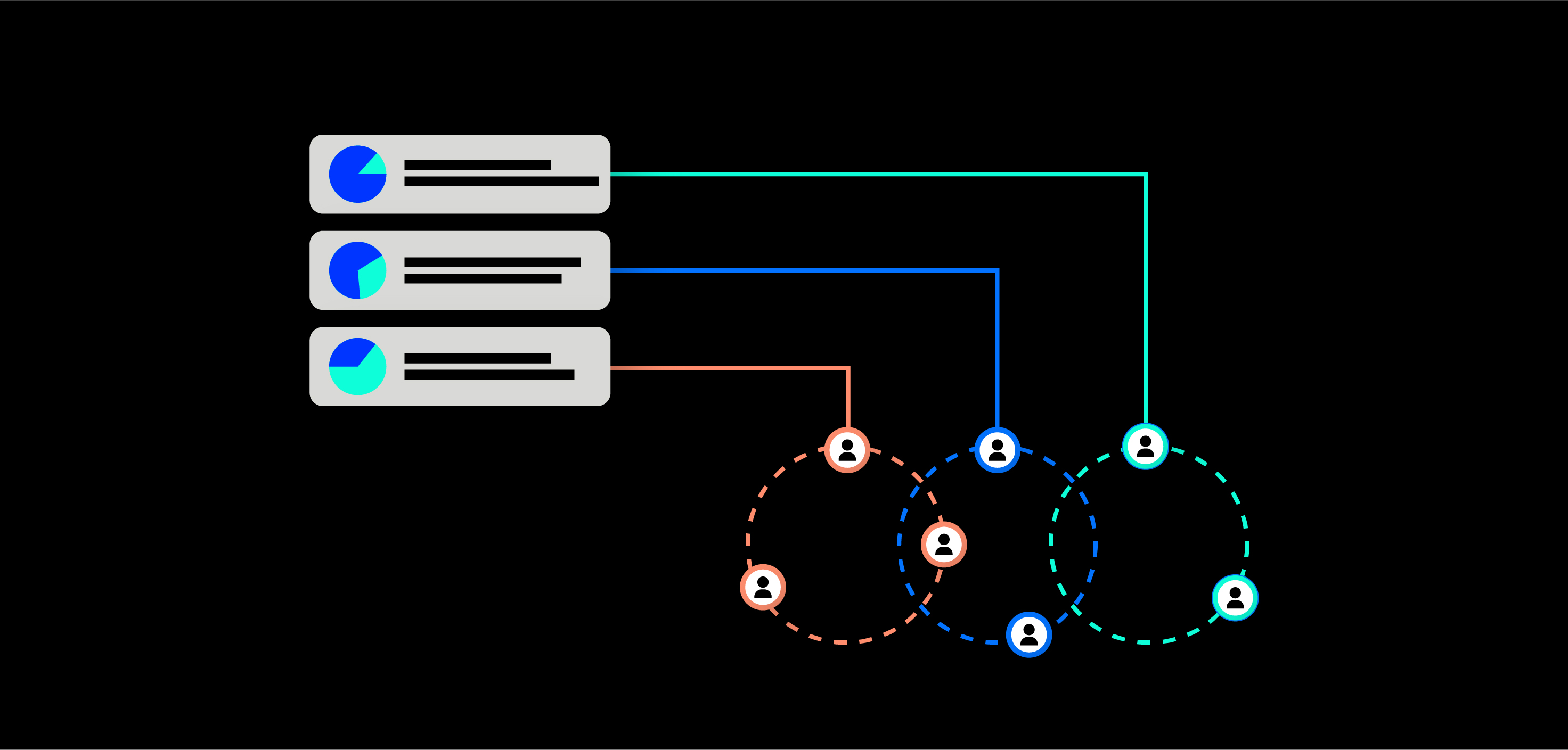

By gathering detailed data from various sources, event tracking enables banks to gain valuable insights. For instance, Dataroid enhances digital experience by collecting every customer interaction on digital and with data-driven insights allows banks to take real-time actions and craft effective product & marketing strategies.

Moreover, event tracking significantly aids in risk management by detecting potential issues early, such as fraud, and enabling quick responses to protect customers and build trust. This proactive approach not only safeguards customers but also strengthens the overall security and reliability of banking services.

The Evolution of Data Analytics in Banking Industry

Data analytics has fundamentally transformed the growth and operation of financial services. In the past, banks relied on historical data to guide their decisions. However, with advancements in technology and access to vast amounts of data, the approach to data analysis has become significantly more sophisticated.

Today, financial service providers use data analytics including event tracking not only to review past performance but also to understand current trends and predict future developments. Predictive analytics enables banks to anticipate customer needs and market trends, allowing them to develop new products and services that resonate with their clients. By examining historical behavioral data, banks can identify patterns and trends that inform smarter business strategies and enhance risk management.

Sign up to drive your business with the power of data

Top 2 Benefits of Event Tracking in Banking

Event tracking is crucial for financial services companies, enabling them to improve their operations and grow their business. By focusing on event tracking, banks can enhance customer satisfaction, better manage risks, and gain valuable insights from case studies that guide them in overcoming challenges.

1. Enhancing Customer Experience through Detailed Insights

By diving into customer data, banks gain a comprehensive understanding of their customers’ preferences and needs. This helps them tailor offerings and communications to everyone, resulting in a more personalized and satisfying customer experience.

By analyzing this data, banks can create products and services that align with individual customer needs, craft personalized marketing campaigns, send timely and relevant notifications, and anticipate future customer needs through predictive analytics. This results in a more personalized and satisfying customer experience.

2. Improving Risk Management with Real-time Data Analysis

Event tracking enhances risk management by continuously monitoring customer data, allowing banks to detect potential risks early and take swift action. This includes monitoring operational risks such as system failures or security breaches, identifying and preventing fraudulent activities, and responding promptly to emerging threats. Real-time updates help minimize potential damage and protect customers effectively.

Overcoming Challenges in Event Tracking

Implementing event tracking in banking presents several challenges. Financial services companies must ensure data privacy, comply with regulations, and overcome technical issues to fully reap the benefits of event tracking.

Ensuring Data Privacy and Compliance

Data privacy and regulatory compliance are paramount in event tracking. Banks and financial services companies must handle customer information responsibly and adhere to laws such as the Gramm-Leach-Bliley Act (GLBA) and the Privacy Act. Implementing strong security protocols to protect customer data from breaches is essential for robust security.

Additionally, banks must obtain customer consent before tracking data and clearly communicate how it will be used. Adhering to all relevant privacy and security regulations is crucial for building customer trust and avoiding legal issues.

Addressing Technical Challenges

Implementing event tracking systems involves several technical challenges, including data integration, handling large data volumes, and ensuring smooth system implementation. Effective strategies include utilizing advanced tools for seamless data integration, which provides a comprehensive view of customer information. Ensuring that the system can handle large data volumes efficiently requires scalable infrastructure.

Detailed planning and extensive testing are necessary to ensure smooth system implementation. By focusing on these key areas, financial services can effectively implement event tracking systems and unlock their full potential.

Best 3 Practices for Effective Event Tracking in Banking

To maximize the benefits of event tracking, banks should follow key best practices to ensure effective data management, continuous improvement, and adaptability. Here are some essential steps for banks to stay on top of their event tracking initiatives:

1. Establishing Robust Data Governance

Strong data governance is crucial for effective event tracking. Financial services companies should implement clear guidelines and methods for handling data to ensure its quality, security, and compliance with legal requirements. Key points to consider include:

- Clear Data Ownership: Define who owns and is responsible for each data set. This keeps data organized and ensures accountability.

- Ensuring Data Quality: Implement methods to verify the accuracy, completeness, and consistency of data.

- Security and Compliance: Protect customer information with robust security measures and adhere to legal requirements like the Gramm-Leach-Bliley Act (GLBA) and the Privacy Act.

2. Continuous Improvement and Adaptation

Event tracking is an ongoing process that requires continuous monitoring, analysis, and improvement. Strategies for continuous improvement include:

- Regular Data Analysis: Frequently analyze customer data to identify trends, patterns, and areas for improvement.

- Adoption of New Technologies: Embrace recent technologies like machine learning and predictive analytics to enhance event tracking capabilities. These technologies can provide deeper insights and improve predictive accuracy.

- Feedback and Collaboration: Actively seek customer feedback and collaborate across departments to identify improvement areas and implement necessary changes effectively.

3. Adapting to Trends and Customer Needs

Banks must be flexible and responsive to changing market conditions and evolving customer preferences. Strategies to stay adaptable include:

- Staying Updated with Trends: Keep up with the newest technological and customer behavior trends.

- Implementing Predictive Analytics: Use predictive analytics to anticipate future customer needs and market shifts, which helps banks stay ahead of competitors.

- Creating Feedback Loops: Establish regular feedback loops with customers and internal teams to ensure continuous improvement and alignment with customer expectations.

By focusing on robust data governance, continuous improvement, and adaptability, financial services can significantly enhance their event tracking capabilities and drive better business outcomes.

Case Study: Akbank’s Success with Dataroid

Akbank’s collaboration with Dataroid highlights the power of event tracking in the banking sector. Utilizing Dataroid’s advanced capabilities, Akbank monitored customer interactions in real-time, enabling swift, data-driven decisions that significantly enhanced customer satisfaction and operational efficiency. This partnership provided detailed insights into customer behaviors and preferences, facilitating highly personalized services tailored to individual needs, which in turn fostered stronger customer loyalty and retention. Additionally, real-time tracking allowed Akbank to promptly address customer needs and issues across various digital channels, significantly improving the overall customer experience.

Akbank’s innovative use of Dataroid’s event tracking capabilities was recognized at the Türkiye Customer Experience Awards (TCXA), where they received the Gold Award for “Best Digital Transformation—Finance.” This accolade highlights the significant impact of event tracking on Akbank’s ability to deliver exceptional customer experiences and achieve operational excellence.

Key Takeaways

Event tracking in banking is essential for understanding customer behavior and enhancing operational efficiency. By leveraging technology, banks can gather and analyze vast amounts of data, allowing them to make informed decisions and improve customer satisfaction. Event tracking also helps banks detect potential risks early, such as fraud, and enables quick responses to protect customers and build trust.

Event tracking in banking provides actionable insights that enable organizations to make informed decisions and improve operational efficiency. These insights are derived from real-time data solutions and offer a comprehensive view of customer interactions, helping banks enhance the overall customer experience. By leveraging modern financial analytics tools, banks can identify trends, reduce costs, manage risks, and plan effectively. Moreover, with real-time data analysis and advanced analytics platforms like Dataroid, banks can personalize services and interactions, significantly boosting the customer experience.

Frequently Asked Questions

How does event tracking differ from traditional data analysis in banking?

Event tracking focuses on real-time customer interactions, unlike traditional data analysis, which reviews past data. This real-time approach helps banks personalize services, improve product development, manage risks more effectively, and stay competitive by understanding customer behavior deeply.

What role does AI play in enhancing event tracking in banking?

AI, through machine learning and predictive analytics, enhances event tracking by analyzing customer data in real time. This improves customer experiences and increases bank profitability by making it easier to interpret data and provide timely, relevant services.

Can event tracking improve the personalization of banking services?

Yes, event tracking enables banks to tailor their offerings to individual customer needs. By using predictive analytics, banks can send personalized marketing messages and provide services that increase customer satisfaction and loyalty.

How do banks ensure the accuracy and reliability of event tracking data?

Banks ensure accuracy and reliability by integrating data from multiple sources, using advanced analytical tools, and adhering to strict privacy regulations. This approach minimizes errors and ensures high-quality, secure event tracking data.

YOU MAY ALSO LIKE

What is User Segmentation? A Complete Guide to Targeting Your Audience

Top 6 Strategies for Increasing Customer Loyalty

How to Perform Customer Behavioral Segmentation in 5 Steps

Enhance Personalized Banking Offers with Behavioral Insights

Driving Growth Through Customer Loyalty

Drive your digital growth

Schedule a demo today to learn more on how we can help you unleash the potential of digital using Dataroid.